Supply and Demand Theory

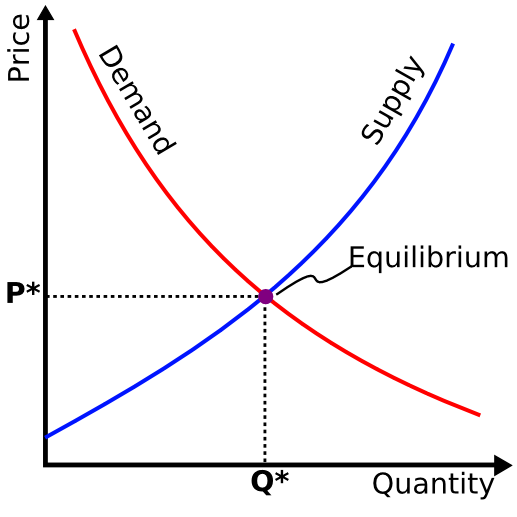

Basic economics is based largely on supply and demand. Simply stated this theory says that the higher the price of a good, the less demand there will be for that good. The lower the price of a good, the more demand there will be for that good. This is easily visualized as follows:

Price Discovery

In a free market system this linkage between supply and demand leads to price discovery – the process by which the market automatically adjusts supply until the optimal price is reached. This is often referred to as the ‘equilibrium’ price.

If the price for a good is above equilibrium there is excessive profit to be made by producers of that good. This will cause additional producers to enter the market to take advantage of the high profits which in turn increases supply and drives down price.

And the reverse is also true. A price below equilibrium lowers profits and causes some producers to stop producing the good. This supply reduction raises the price.

In this way, any time a price deviates from the equilibrium price, there will automatically be correcting forces which will push the price back to equilibrium. This price discovery mechanism is the bedrock of a free market system and always leads to optimal prices for goods.

Government Mucks It Up

Almost all government programs are started with good intentions, but when you look at what they actually achieve, there is a general rule. Almost every such program has results that are the opposite of the intentions of the well-meaning people who originally backed it. – Milton Friedman

Left to its own devices, the free market system has an amazing ability to respond to shortages or surpluses in an agile manner. Further, since no oversight or intervention is needed, this system incurs no overhead costs and does not require a wealth sucking bureaucracy.

Unfortunately, government cannot resist the temptation to interfere with the free market through a variety of mechanisms. Subsidizes, rent control, interest rate setting and many other schemes all accomplish the same thing: They fundamentally break the price discovery mechanism of the free market and, in all cases, necessarily lead to inefficiencies and exacerbate problems.

The remainder of this post will go through a few examples of government interference in the price discovery mechanism and demonstrate the sometimes subtle ways these interventions exacerbate the existing perceived problem or transfer the problem to another sector or group within the economy.

Hurricane Sandy and Gasoline Price Fixing

Last October the eastern seaboard of the United States, including New Jersey and New York, took the full wrath of Hurricane Sandy. In its wake, with millions left without power and unprepared, gasoline (as well as other essentially commodities) underwent a surge in demand. The result was entirely predictable by looking at the above supply/demand chart: Prices rose. First to $5/gallon and then within days into the $10-$15/gallon range.

At this point prices started to stabilize and even fall slightly. But the respite was brief as Governor Christie and other economically illiterate officials started jawboning about prosecuting price gougers and warning against any price increases above the state mandated 10% permitted during a state of emergency. This immediately drove the black market price for gasoline up to $20/gallon and the shortages deepened.

This government response was completely predictable and, most people would argue, necessary. But, by interfering in the free market system which was already working automatically to resolve the crisis, this government imposition of price controls actually prolonged the crisis. After all, what good is $4 gas if there’s none to buy? This was exactly the situation in the aftermath of Sandy – artificially low prices and chronic supply shortages.

But now consider what would have happened if the politicians had allowed the free market to work. The initial phase of the crisis would have been the same: Increased demand leading to higher prices. But these higher prices would have attracted an immediate increase in gasoline supply. Think about it: If you’re a supplier in a neighbouring state with a tanker full of gasoline would you sell it locally for $4/gallon or send it to a market where you could sell it for $10 or $15/gallon?

Thus, under the free market system, within days there would have been a massive influx of gasoline into affected regions from unaffected regions as suppliers chased profits. This influx in supply would have reduced both the prices and shortages of gasoline.

This is not to say that prices wouldn’t have settled at an elevated level. After all, these out-of-state suppliers are incurring additional overhead to deliver their product to a more distant market and are also incurring risk sending capital assets (i.e. the trucks) into storm damaged regions. But, certainly the premium would not have been more than a few dollars a gallon and any shortages would have been eliminated in short order.

Hurricane Sandy provides one great example of how, despite their best intentions, government interference with the price discovery system inevitably exacerbates problems.

Rent Control

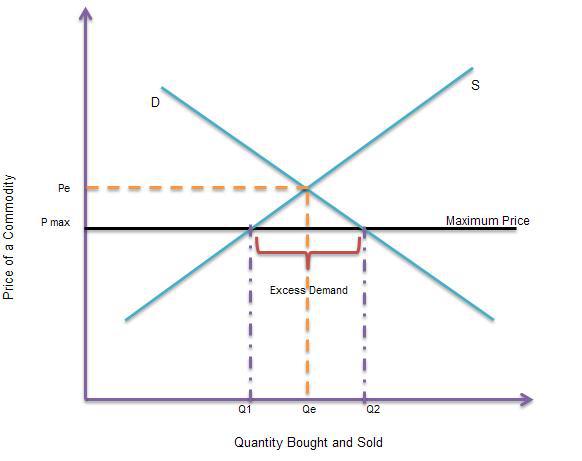

Another great example of the unintended consequences of government interference in the free market is rent control. When the government imposes rent control it suppresses the price such that it is below equilibrium. Visually, it looks like this:

Notice that this hard ceiling on price has resulted in the following:

- High demand due to the low price.

- Low supply due to the lack of profits.

These two forces act in opposite directions to force acute and chronic housing shortages. In the above diagram we can quantify the shortage as Q2 – Q1.

Even worse, the establishment of a price ceiling below equilibrium has resulted in a situation where the profits for suppliers of housing (i.e. builders and landlords) is reduced. In this situation these suppliers have little incentive to build additional housing and thus the shortage becomes chronic.

Another unintended consequence is that because the cost per square foot is artificially low, individuals have less incentive to economize by taking less space. Thus, the same aggregate square footage of available housing tends to be consumed by fewer and fewer people at lower and lower prices. If the price was allowed to increase people would adjust by reducing their space needs, subletting, etc.

Notice that simply allowing the price to find the natural equilibrium would resolve the housing shortage. Even if the equilibrium price is initially prohibitively high, this will simply cause a quick housing boom to occur as builders chase profits. This housing boom will naturally solve the shortage and cause the price to drop.

Commodity “Stabilization”

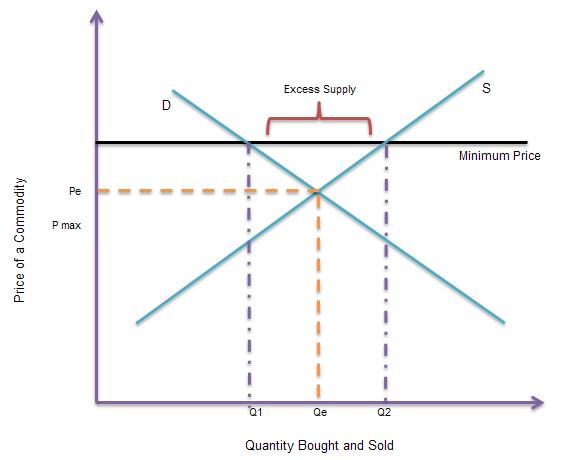

But the government doesn’t just fix prices artificially low. Often government intervenes to fix a price above the equilibrium price. One example of this is for agricultural crops. Let’s use corn as an example.

It’s inevitably argued that price fixing policies are required to ‘stabilize’ the price of corn. This stabilization can be in response to certain market conditions or simply because at harvest time the price of the corn naturally falls for a period due to the increased supply. It’s at these times, says the government, that the evil speculators step in and buy the corn at low prices to store it and sell later in the season once the price increases.

This evil speculator argument sounds good but, when analyzed rationally, is nonsensical.

First of all, the speculator is doing nothing that the farmer couldn’t do himself. Nobody holds a gun to farmers’ heads and forces them to sell at harvest time. Those farmers are free to store their corn in grain silos until the price goes up just as the speculators do. The reason some farmers are willing to sell when the price is lowest at harvest time is because there are costs and risks to storing. First of all there is clearly a capital investment required – you have to put all that corn somewhere. Secondly, the farmers are deferring income which carries its own costs – namely risk (insurance, uncertain market conditions, etc.) and forgone investment potential on the money for the period of the delay.

The reason speculators are important is exactly because they are willing to incur these additional costs and risks for a future profit. By doing so the speculators are performing an important function: They stabilize supply and with it price. By buying during times of excess supply and selling during times of shortages the speculator is, in fact, stabilizing the market and reducing seasonal price fluctuations.

But alas, the government often doesn’t see the logic of this and, with the support of the agricultural lobby, enforces a price that during harvest time is less than the free market price. The situation they create looks like this:

By setting the price of corn at an elevated level an oversupply is created. This has a few effects:

- Inefficient farmers are not forced out of business as they would otherwise have been. The natural free market mechanism of perpetuating the most efficient producers and forcing inefficient producers to improve efficiency or go out of business is broken.

- Consumers pay more and as a result they consume less (demand falls).

- Imports of corn must have tariffs applied or be otherwise restricted to maintain the high price.

- Unless production by domestic farmers is restricted, chronic and building oversupply will become a major problem.

Unless the government regulates all production to force supply to the Q1 level (i.e. production limits) something akin to an asset bubble in the corn market is created. Unchecked, this, like all bubbles, must burst at some point leading to even greater price volatility.

The take away here is that, once again, government interference with the price discovery mechanism only serves to exacerbate problems that the free market is quite able to resolve in the most efficient manner possible. In the case of setting artificially high prices the main result is that consumers get less of a good at a higher price.

Conclusion

The free market system always leads to optimal prices. The price discovery mechanism will dynamically adjust to shortages, oversupplies or any other disruptions or changes in the market. There is nothing government needs to do other than trust in the natural profit seeking behaviour of the individual and stay out of the way.

It is important to note that in most cases the government is attempting to act in our best interests with their free market manipulations. But you can’t fix an optimal system. Any attempt to regulate or control such a system will inevitably make the system less efficient. That neither we as a citizenry nor our political leaders have internalized this fact and educated ourselves in basic common sense economic theory leads to misguided attempts to fix something which isn’t broken.

Finally, these ill-advised attempts at market rigging introduce additional overhead into the system in the form of the army of bureaucrats needed to draft and administer the regulations. Government gets larger, the market gets less efficient, and the individual consumer pays the price.

You may also like:

- Bondpocalypse

The 30 year bull market in bonds is coming to an end. Attempts to keep the financial system from collapsing over the last five years have merely set the stage for a larger collapse. Government debts have exploded. Central banks have desperately lowered interest rates to near-zero and resorted to outright monetization of the debt. Recent events show us that the mere suggestion of possible future tapering is enough to cause an immediate and violent reaction in bond yields.

There’s no way out. The bondpocalypse come’th.

- Interest Rate Setting: Welcome to the Managed Economy

Were governments to raise all funding through taxes the people would revolt. Inflation provides a mechanism whereby people can be taxed without their knowledge or understanding. This currency debasement is only made possible due to the control of interest rates and the extent to which this is able to distort, obfuscate and manipulate the economy. We have allowed the State to eliminate the free market for the most important price that exists in a capitalist system: The price of money – interest rates. In so doing we consigned ourselves to a permanently sub-optimal economy.

No, we don’t have free market capitalism. Not even close. Welcome to the managed economy.

- The Cyprus Bail-In: Part Four – A Template for Canada

- The Cyprus Bail-In: Part Three – A Template for the…

What do I care about efficiency of markets? Feed the hungry, clothe the naked, and house the homeless. Your stupid theories just muck up these truths. Markets, S & D are far from perfect perfect concepts. Markets are routinely commandeered and bastardized by non-governmental entities and it requires government to step in and remediate the damage. Free markets always lead to one thing: Monopolies.

Idealistic.

However, there has never ever been a time where government has not “interfered” with the market(s). Not ever.

Sometimes I like to fantasize about pure unfettered markets, too! I even like to pretend that we live in an unfettered free market economy! Ahhhh!

But, back to reality.

free market will cause to free from taxes and yet tgey are needed to rduce gvmt debt.